Hybrid Bankingfor Global Business

Effortlessly integrate with traditional financial systems while staying crypto-friendly.

With DigiTap, setting up a business account is simple and designed for modern companies. You can create multiple dedicated accounts and digital wallets, as well as issue secure payment cards for your team members.

Effortlessly send and receive payments in both fiat and cryptocurrencies, with instant conversion to the currency you need. A DigiTap business account gives you the flexibility to transact globally — with any partner, in any currency, and at any scale.

Banking Tools for Modern Businesses.

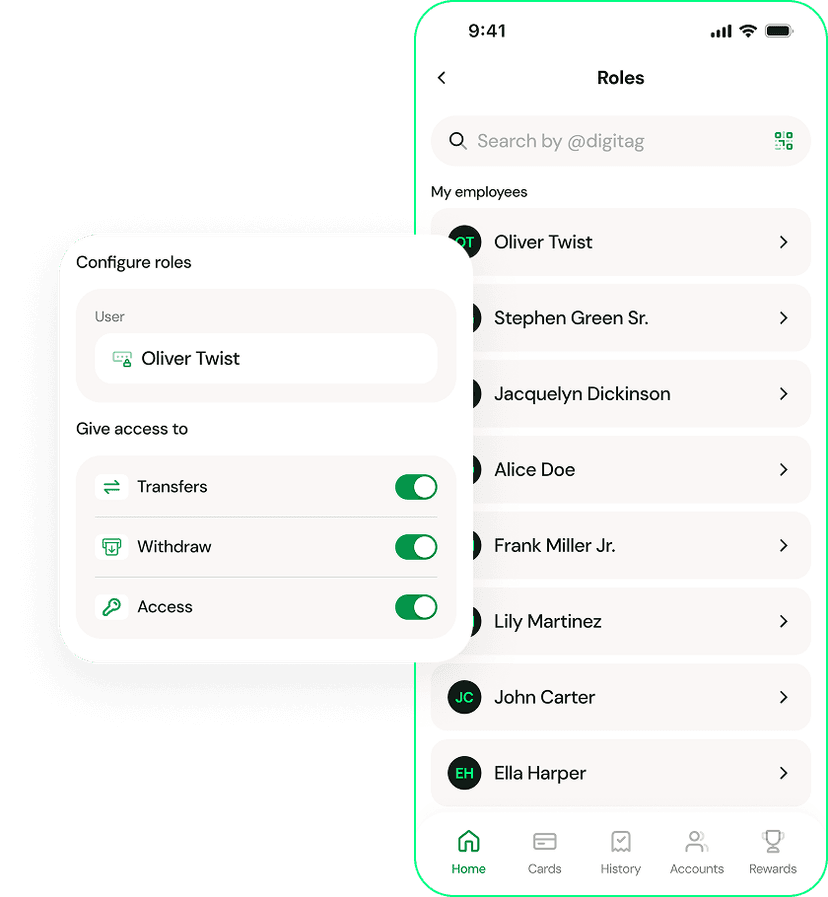

Empower Your Shareholders

With role-based permissions, you can ensure stakeholders see exactly what they need while maintaining total security and oversight. Provide full transparency and control by granting shareholders secure access to company accounts. Share real-time visibility of funds, track all banking operations, and present detailed financial reports — all from one centralized platform.

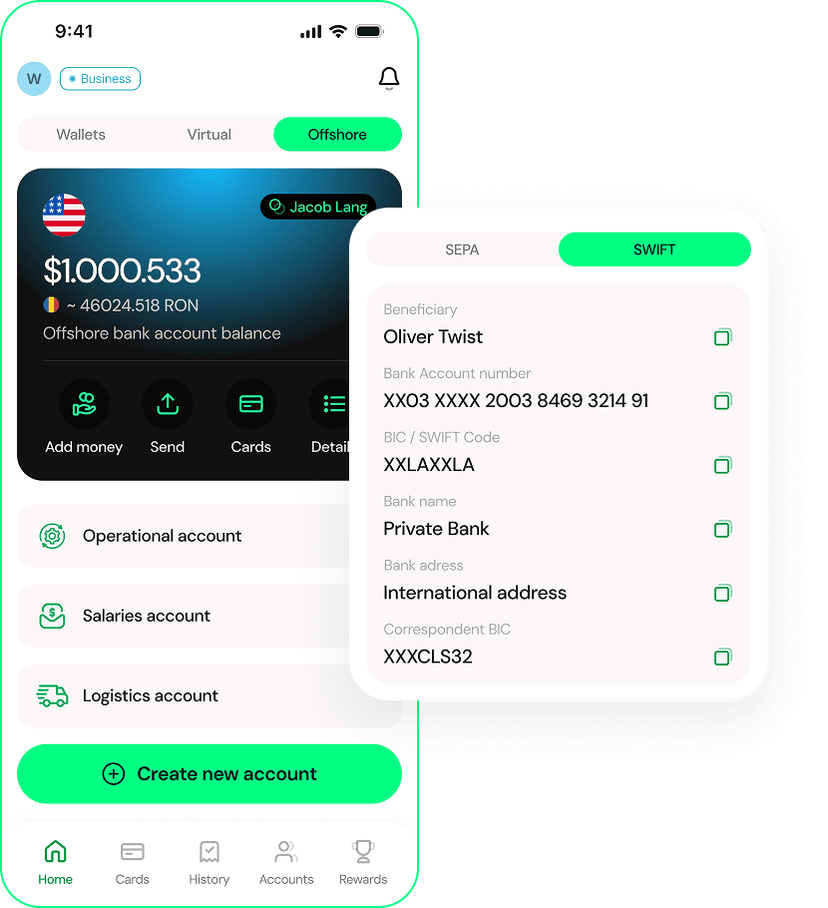

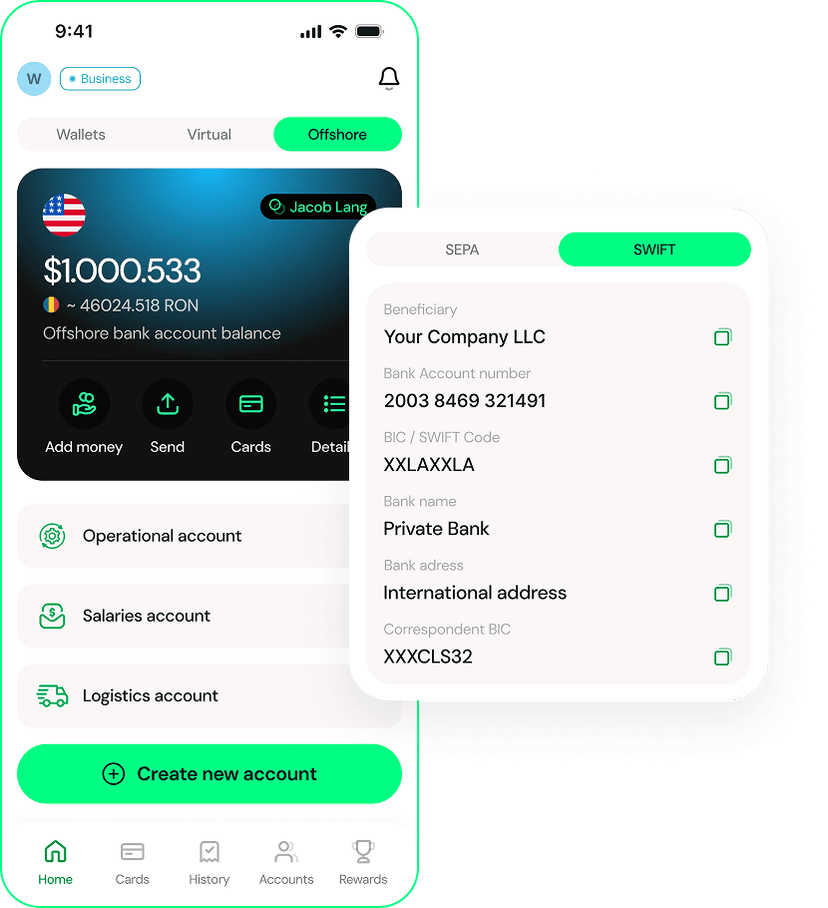

Structured Multi-Account Setup

Simplify financial management by creating dedicated wallets and bank accounts for various business needs. Manage different business units, projects, or revenue streams with clear separation of funds, dedicated statistics, and full control over every account.

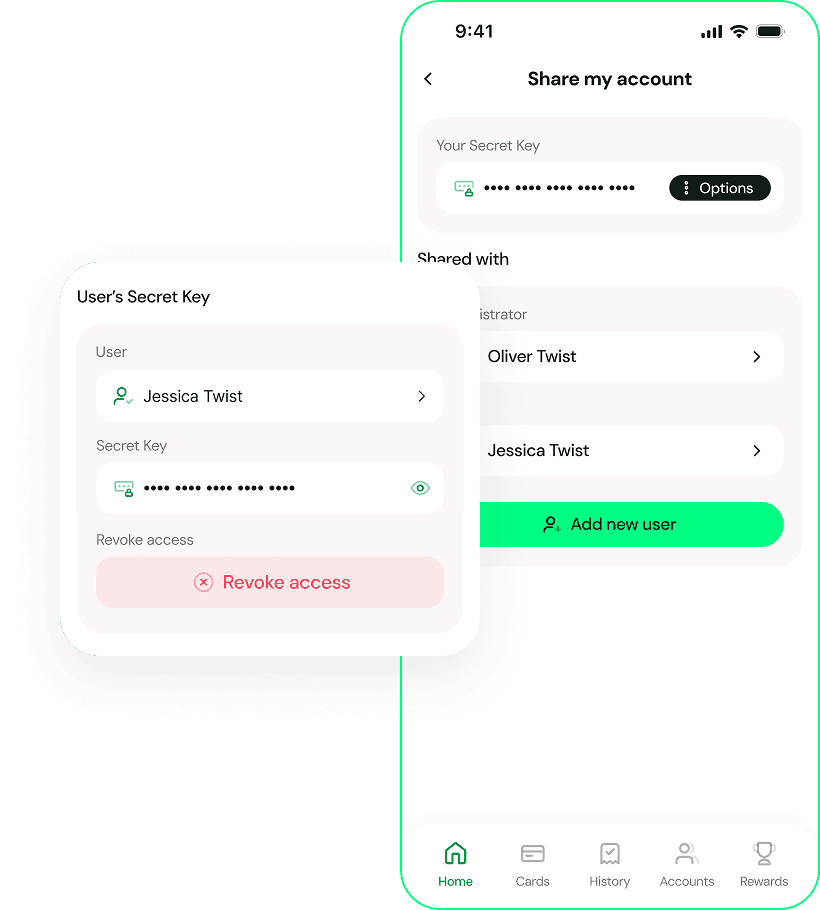

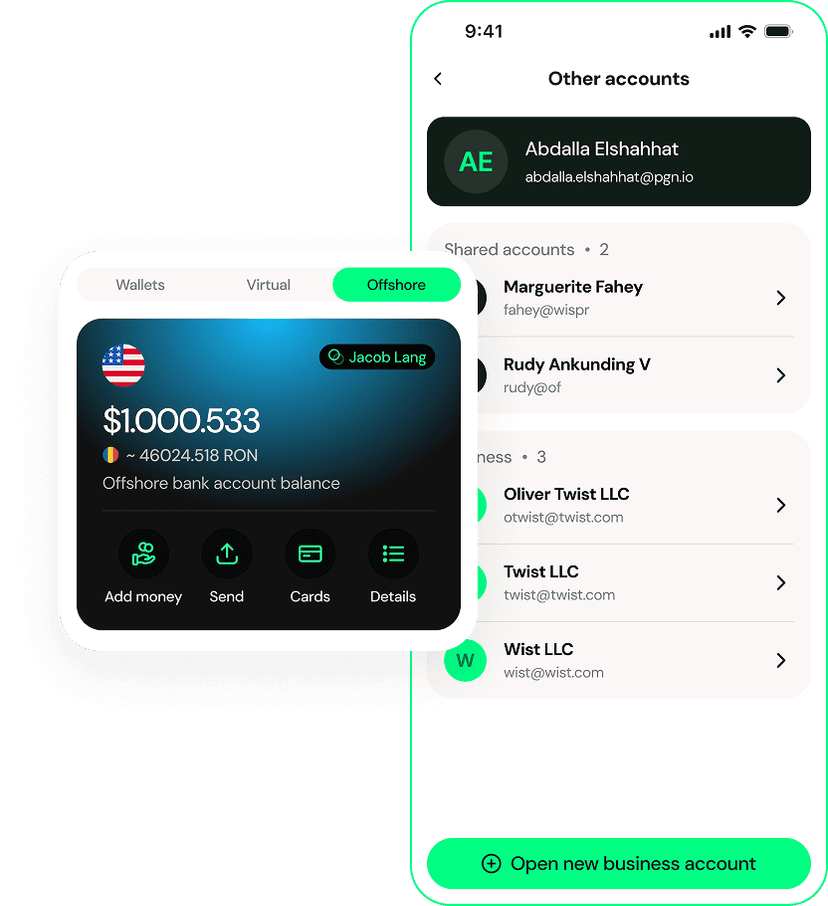

Smart Account Sharing for Teams

Leverage role-based account permissions to share company wallets, cards and bank accounts with employees. Track every transaction in real time with advanced analytics, enforce spending controls, and ensure complete visibility into business finances through an intelligent, centralized platform.

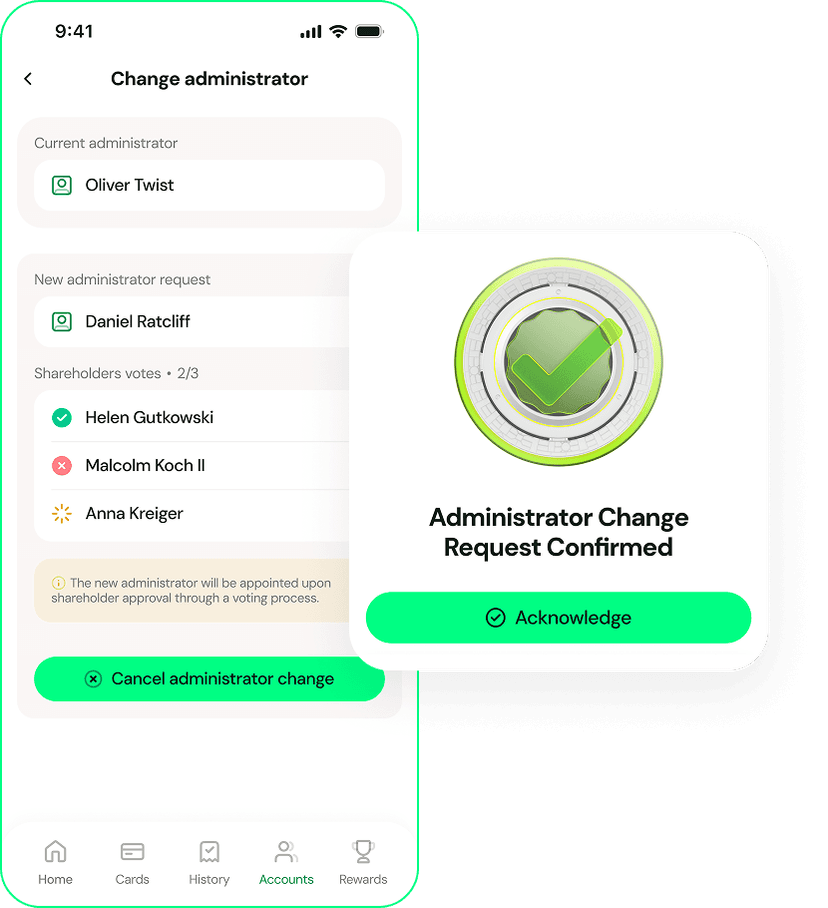

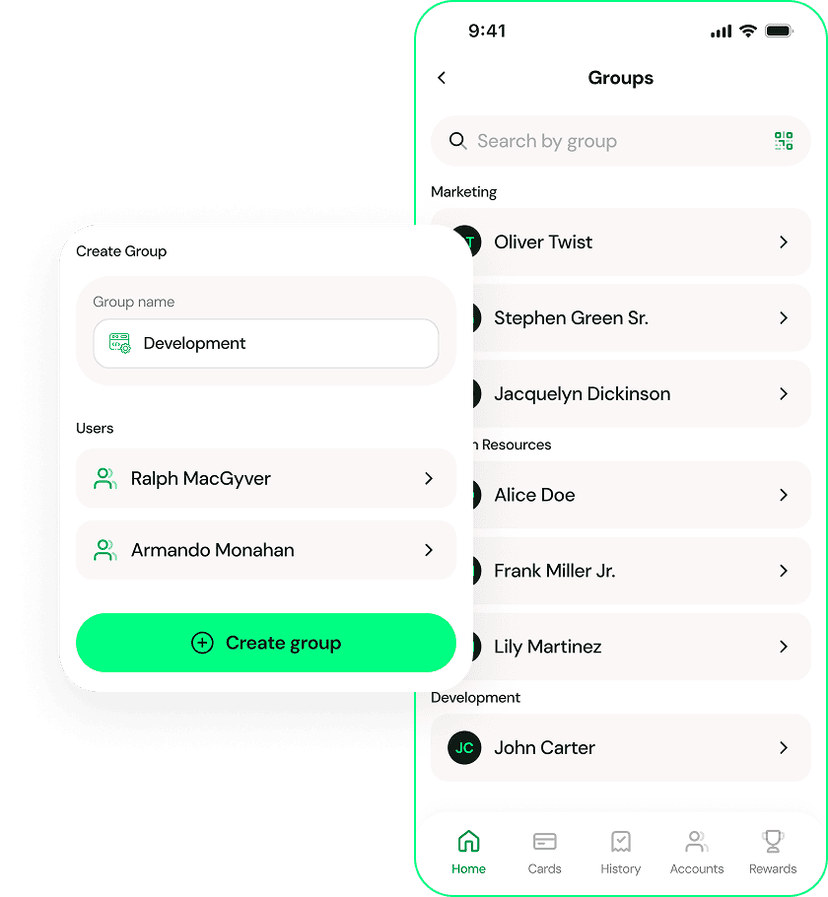

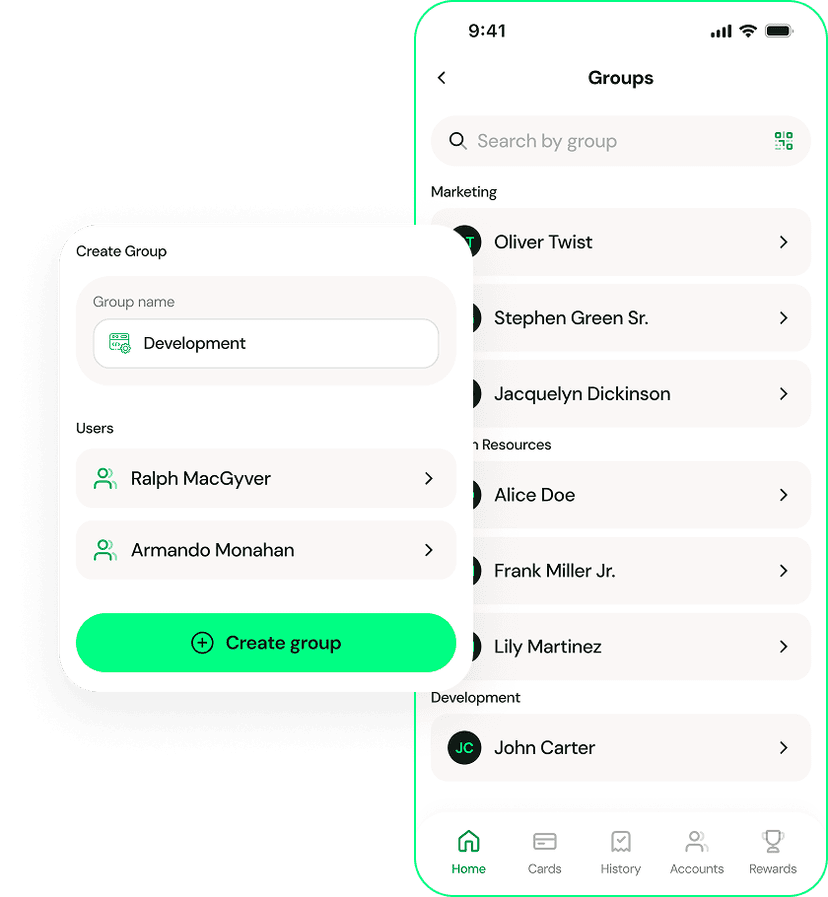

Flexible Control of Your Board

Leverage advanced role-based controls to add or replace board members in real-time. Our platform ensures authorized users can manage funds and oversee transactions through a secure, data-driven dashboard with instant updates.

Smart Salary Solutions for Modern Teams.

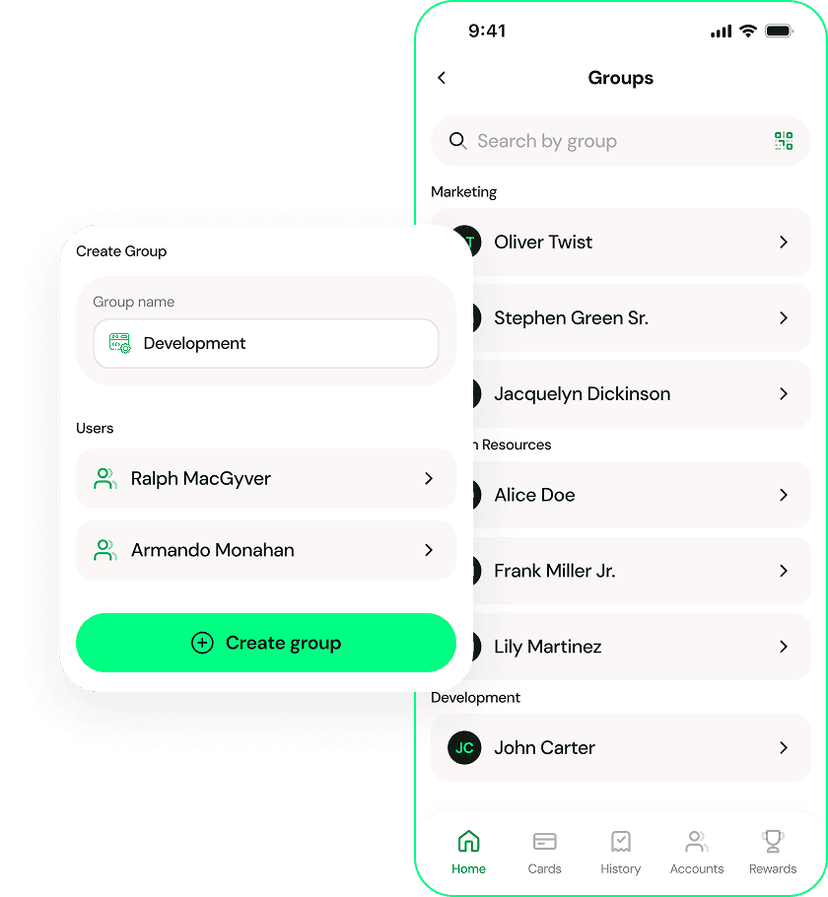

Group Payments Made Simple

Effortlessly create payment groups for your employees, regardless of where they bank. Automate recurring transactions like salaries and bonuses while maintaining clear oversight and detailed reporting — ensuring smooth operations and an elevated financial experience.

Advanced Payment Scheduling Tools

Automate and scale your financial workflows with smart payment templates. Upload or sync data in formats like CSV or XLS, or build recurring payment schedules directly in the app — ensuring seamless, rapid, and error-free execution.

Tailored Incentives, Delivered Effortlessly

Leverage performance data and custom rules to trigger automated bonus payouts. DigiTap’s intelligent system ensures accurate, fast, and transparent reward distribution tied directly to measurable achievements.

Access Without Compromise

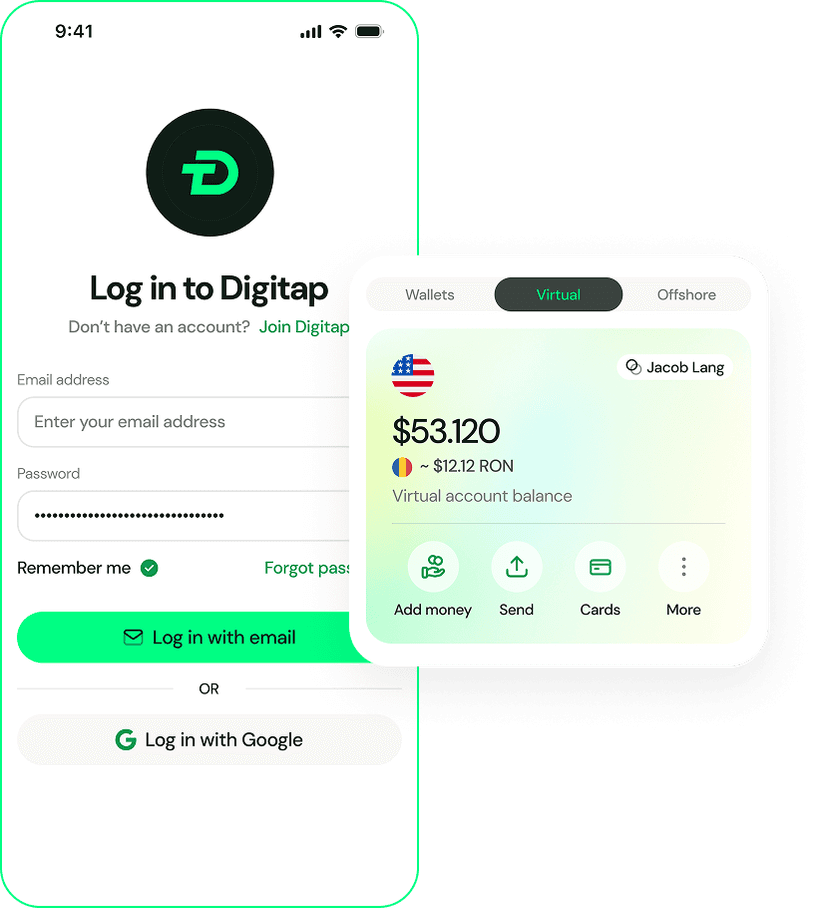

Unified Business and Personal Access

Harnessing advanced account abstraction, DigiTap allows admins to control company funds and operations directly from their personal account. No separate logins or software needed — just instant, secure access to both personal and corporate accounts in one place.

Streamlined Credential-Based Access

Use your email and password or google credentials to gain instant entry to your company accounts. Backed by cutting-edge authentication protocols, every login is encrypted and monitored for maximum protection.

Tailored Access for Every Role

Empower your team with access designed to match their responsibilities. From controlling funds and issuing cards to accessing financial insights, DigiTap lets you define roles and set granular authorizations for each member. This level of precision ensures your company runs efficiently while maintaining the highest level of control.

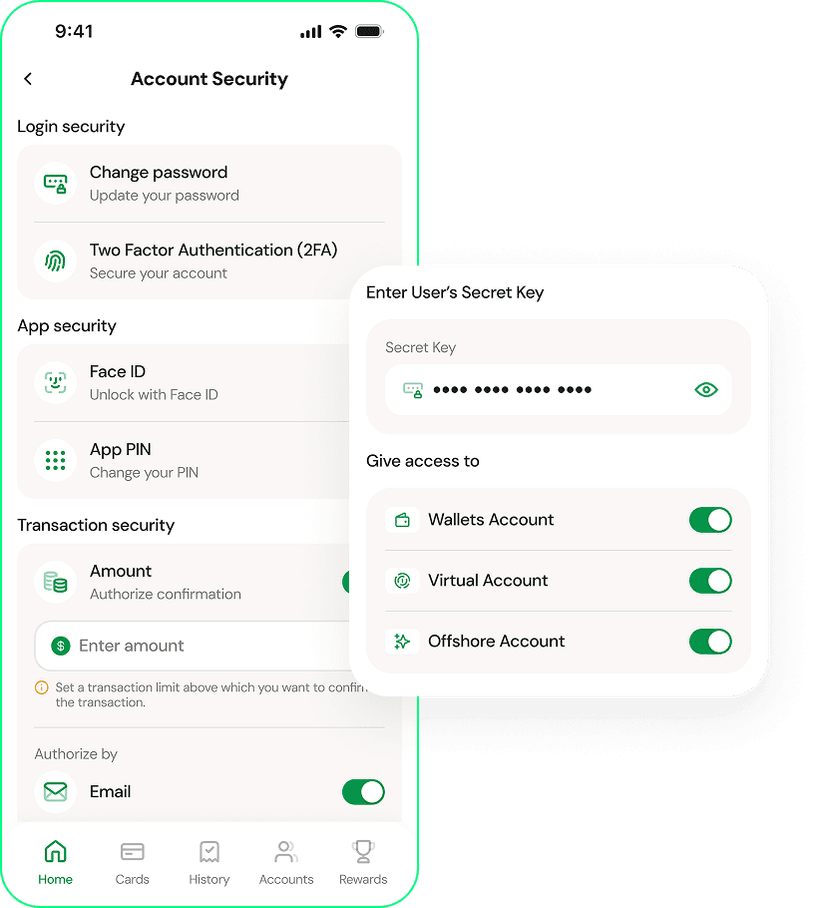

Enhanced Protection for Peace of Mind

Safeguard your company accounts with advanced security measures tailored to your needs. Activate multi-layered authentication, including 2FA, device whitelisting, access keys, and secure wallet integrations, ensuring your financial operations remain private and protected at all times.

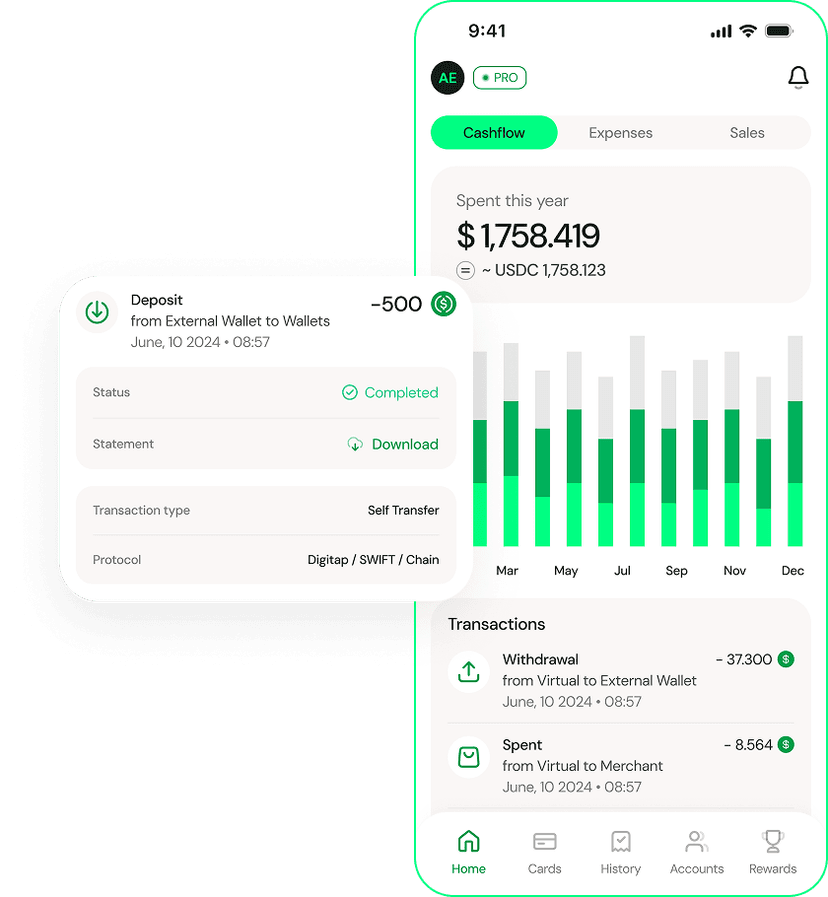

Stats & Analytics

Live Data and Detailed Reports

Harness dynamic dashboards that give you complete visibility into budgets, transactions, and user activity. DigiTap’s live tracking tools let you analyze financial behavior and access data-driven insights with full customization and control.

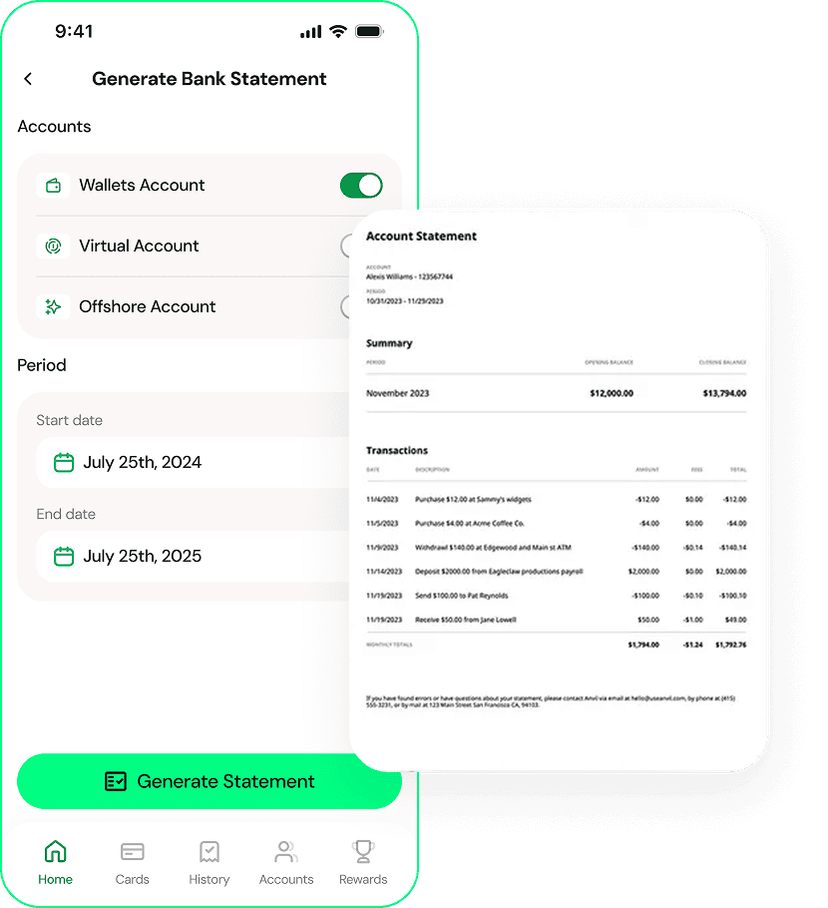

Bank Statements & Financial Reports

Leverage DigiTap’s technology to instantly produce detailed bank statements with a few clicks. Whether for a single wallet, a bank account, or aggregated company-wide data, our system delivers fast, exportable statements with advanced formatting options.

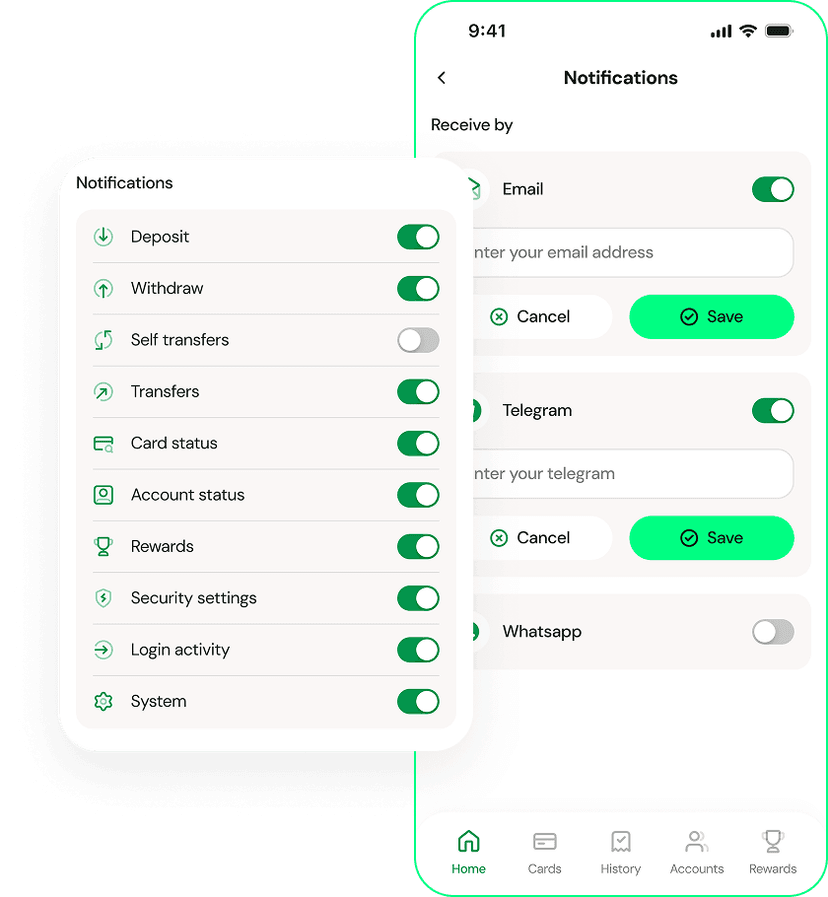

Intelligent, Real-Time Alerts

Harness advanced notification tools that adapt to your business needs. Create custom alerts for fund usage, access permissions, or merchant activity, and receive real-time updates designed to optimize performance and decision-making.